Diversification and risk management are crucial concepts for anyone looking to navigate the realm of asset allocation. By spreading holdings across a variety of categories, individuals can reduce vulnerability to fluctuations in any single area, thereby enhancing overall portfolio stability.

At its core, diversification is about balance. Imagine if all of your resources were placed in one basket. If the value of that basket drops, so does your overall portfolio. However, by distributing assets across different categories, sectors, or geographic regions, the adverse performance of one can potentially be offset by the favorable performance of another. For instance, when technology assets experience volatility, other areas like consumer goods or healthcare might remain steady or even rise, mitigating potential losses.

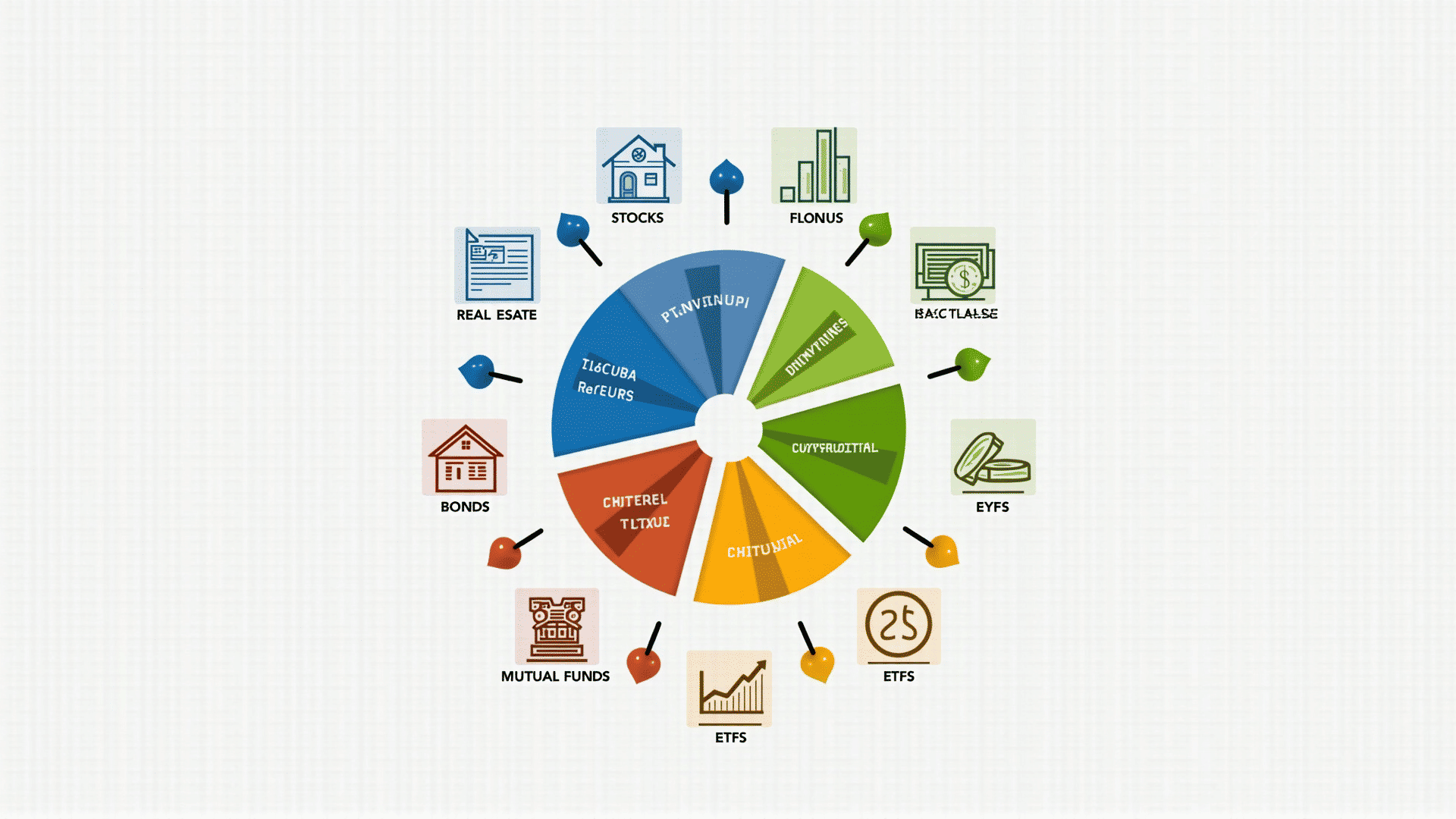

A well-rounded allocation might include various categories such as equities, bonds, and commodities. Each asset class behaves differently under diverse economic conditions, which can serve as an effective buffer against market unpredictability. Equities may offer growth potential, while bonds might provide more steady returns. Commodities, like precious metals, can serve as a hedge against inflation.

Geographic distribution is another consideration. By placing resources in different countries or regions, you can further minimize risks associated with economic downturns in a specific locale. This global approach taps into the growth potential of emerging regions while benefiting from the stability of more established markets.

To establish an effective diversification strategy, assess your risk tolerance. Are you comfortable with high potential returns accompanied by high risk, or do you prefer steady growth with lower risk? Understanding your comfort level with risk will guide your choices and help construct a balanced portfolio.

Regular evaluation of your holdings is also essential to maintain balance. Over time, some categories may grow faster than others, potentially skewing the desired allocation. Rebalancing periodically ensures that your asset distribution aligns with your original risk tolerance and financial goals.

In conclusion, diversification and risk management are foundational principles for achieving a stable and resilient portfolio. By understanding these strategies, individuals can protect their assets from unforeseen downturns and endure over the long term. Through careful planning and ongoing assessment, you can harness the benefits of varied asset allocation, preparing for both challenges and opportunities in the financial landscape.