Understanding Asset Allocation with Optra

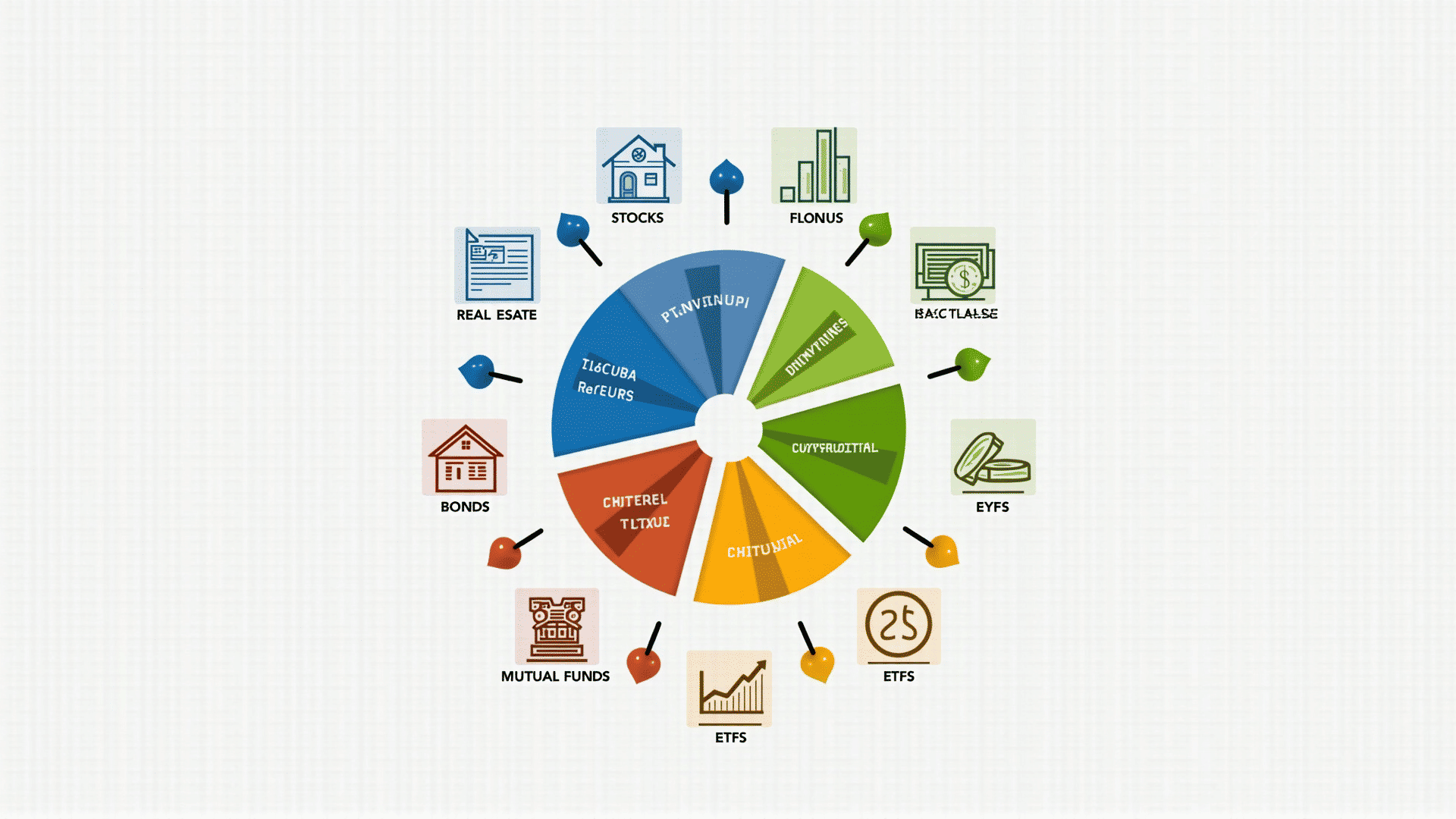

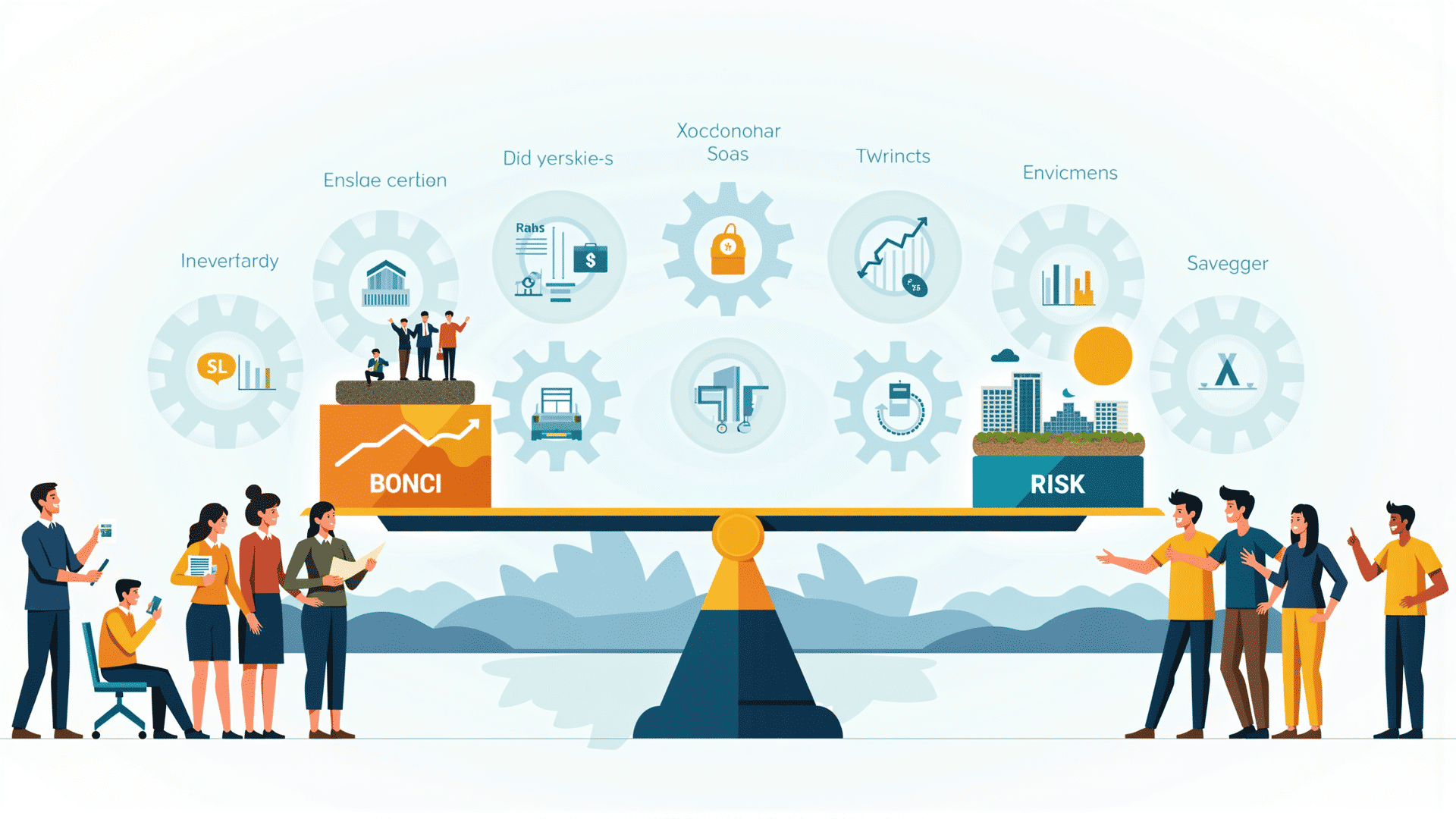

Explore the world of asset allocation and how it plays a pivotal role in your economic journey. Asset allocation is not just about choosing investments; it's about understanding how to diversify your portfolio to manage risk and navigate through different economic cycles. Optra helps you grasp the fundamentals of portfolio theory, providing essential knowledge for smarter decision-making. Enhance your financial literacy today with our resources and empower yourself in an ever-changing market environment.